COVID Relief Package

President Donald Trump on Sunday night signed a $900 billion Covid relief package into law, days after he suggested he would block the bill if the stimulus checks weren't raised to $2,000, from $600. But that never happened: House Republicans quickly shot down Democrats' attempts at passing $2,000 payments.

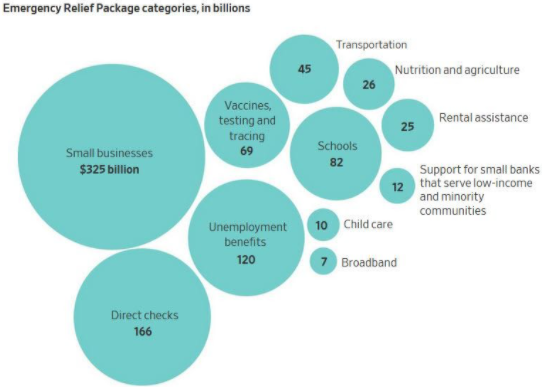

Here is the breakdown of everything inside The $900BN Stimulus Bill:

Direct Payments:

Direct Payments:

The legislation would authorize a second round of economic-impact payments, following the checks Americans received in the spring and summer, at a cost of $166 billion. Households would receive $600 for each adult and $600 for each dependent, instead of $1,200 and $500, respectively, in the first round. Mixed-status households, where some people are ineligible noncitizens, would get payments based on the number of eligible people in the households, as opposed to being shut out as they were in the first round.

The payments would be based on income from 2019 and begin phasing out for individuals with adjusted gross incomes over $75,000 and married couples over $150,000. Treasury Secretary Steven Mnuchin said Monday that the first electronic payments could reach bank accounts by the beginning of next week. Households whose incomes were too high to qualify or who added dependents in 2020 might not qualify for full payments immediately. But they can request additional money as part of the 2020 tax returns they will file in early 2021.

Jobless Aid:

Workers would be eligible for a $300-a-week federal unemployment subsidy. As with the prior aid package enacted in March, gig workers and others who don’t ordinarily qualify for benefits would be eligible for the jobless aid. The money is available through March 14. It’s not retroactive. The legislation would also extend to 50 weeks the amount of time for which workers may claim benefits through both state and federal programs. Most states typically provide 26 weeks of jobless benefits.

The measure also provides an additional $100-a-week subsidy for workers who have both wage and self-employment income but whose basic unemployment benefits don’t take into account their self-employment income. The cost of the enhanced unemployment benefits are projected at $120 billion.

Rental Assistance:

The bill provides $25 billion of assistance to tenants in arrears on their rent. It also extends until the end of January 2021 a federal eviction prohibition, which the incoming Biden administration may extend again. The Treasury Department would be responsible for dispersing the rental assistance to states via a formula based on population. Landlords and building owners can apply on behalf of tenants meeting the eligibility requirements, generally those who make less than 80% of median income in their area, have at least one person in their households who has lost a job and can demonstrate they are at risk of losing their home.

Rail and transit:

The bill would provide $1 billion in relief funds to Amtrak, aimed at helping the national passenger railroad avoid further layoffs and furloughs of its workers. Amtrak receives a regular operating subsidy of around $2 billion a year from the federal government, but its ticket revenue was devastated by the pandemic and lockdown orders. Ridership on some routes fell by more than 90% this year. The company says it will need a total of $4.9 billion in relief aid to get through the remainder of the year without deeper worker and service cuts. The bill also sets aside $14 billion for transit systems, many of which are considering major cuts in service and layoffs. In New York City alone, elected officials say they need an immediate $4.5 billion infusion to stave off severe reductions in subway and bus service. The bill also sets aside $2 billion for the bus industry and $10 billion for state highways.

。

Taxes:

Aside from the PPP break, the bill would extend a tax credit for struggling employers who keep workers on the payroll, and it would let recipients of certain tax credits qualify based on their 2019 incomes; in some cases, lower 2020 incomes could reduce their eligibility. The bill would also temporarily extend tax breaks for renewable energy, including incentives for wind energy and carbon capture. It also includes deductions for business meals, a provision that President Trump backed but that faced criticism from Democrats as a subsidy for three-martini lunches and indoor dining during a pandemic. Lower excise taxes on beer, wine and spirits that were set to expire Dec. 31 will be permanently extended, and tax incentives for investing in low-income areas and hiring workers from disadvantaged groups would be extended for five years.

下一輪經濟紓困支票正在路上

您需要知道怎麼回事?

美國總統唐納德·川普週日晚簽署了一項9000億美元的COVID救濟計劃,使其成為法律,幾天后,他建議如果刺激救濟沒有從600美元提高到2000美元,他將阻止該法案。但這從未發生過:眾議院共和黨人迅速否決了民主黨人通過的2,000美元付款的企圖。

以下是9000億美元經濟紓困法案內的所有內容的細目:

直接付款:

還繼美國人在春季和夏季收到支票之後,立法將授權第二輪經濟影響付款,預算為1,660億美元。家庭將為每個成年人獲得600美元,為每個受撫養人獲得600美元,而不是第一輪的1200美元和500美元。混合狀態家庭(其中有些人不符合非公民身份)將根據家庭中符合條件的人數獲得付款,而不是像第一輪那樣被拒之門外。

付款將基於2019年的收入,並開始逐步淘汰調整後總收入超過75,000美元的個人和超過150,000美元的已婚夫婦。財政部長史蒂芬·姆努欽週一表示,首批電子付款可能會在下周初到達銀行帳戶。收入太高而無法獲得資格或在2020年增加家屬的家庭可能沒有資格立即獲得全額付款。但他們可以要求額外的資金,作為他們將於2021年初提交的2020年納稅申報表的一部分。

失業援助:

工人將有資格獲得每週300美元的聯邦失業補貼。與三月份制定的援助計劃一樣,零工工人和其他通常沒有資格獲得福利的人也將有資格獲得失業援助。這筆款項可在3月14日之前使用。它不具有追溯力。這項立法還將把工人可以通過州和聯邦計劃申領福利的時間延長至50週。大多數州通常提供最長26週的失業救濟金。

該措施還為同時擁有工資和自僱收入但基本失業福利未考慮其自僱收入的工人提供每週100美元的額外補貼。增強失業救濟金的成本預計為1200億美元。

租金援助:

該法案為拖欠房客的租金提供了250億美元的援助。它還將聯邦的被驅逐禁令的期限延長至2021年1月,新的拜登政府可能會再次延長該禁令。財政部將負責通過基於人口的公式將租金援助分配給各州。房東和房屋所有者可以代表符合資格要求的租戶提出申請,通常是那些收入不超過其所在地區中位收入80%的人,並且其家庭中至少有一名失業者並且可以證明自己處於危險之中失去住所。

鐵路和運輸:

利該法案將向美國鐵路公司提供10億美元的救助資金,目的是幫助國家客運鐵路公司避免進一步裁員和休無薪假。 Amtrak每年從聯邦政府獲得約20億美元的常規運營補貼,但其票務收入卻因大流行和封鎖令而遭受嚴重破壞。今年,某些航線的乘車率下降了90%以上。該公司表示,在今年剩下的時間裡,將需要總計49億美元的救濟援助,而無需進行更深入的人員和服務削減。該法案還預留了140億美元用於運輸系統,其中許多正在考慮大幅削減服務和裁員規模。僅在紐約市,民選官員表示,他們需要立即註入45億美元資金,以防止地鐵和公交服務的大幅減少。該法案還為公交行業預留了20億美元,為國家高速公路預留了100億美元。

稅收抵免:

除了PPP中斷之外,該法案還將為掙扎著將工人留在工資單上的雇主提供稅收抵免,並將使某些稅收抵免的接受者能夠根據其2019年的收入來符合資格;在某些情況下,較低的2020年收入可能會降低其資格。該法案還將暫時擴大對可再生能源的稅收優惠,包括鼓勵風能和碳捕集。這還包括對商務餐的扣減,這是川普總統支持的一項規定,但由於在大流行期間提供三杯馬提尼午餐和室內用餐的補貼而受到民主黨的批評。將於12月31日到期的啤酒,葡萄酒和烈酒的較低消費稅將被永久性延長,對低收入地區投資和僱用弱勢群體的工人的稅收優惠措施將延長五年。