For more information visit ITC website or contact us at (718)461-2871 Rules and Steps

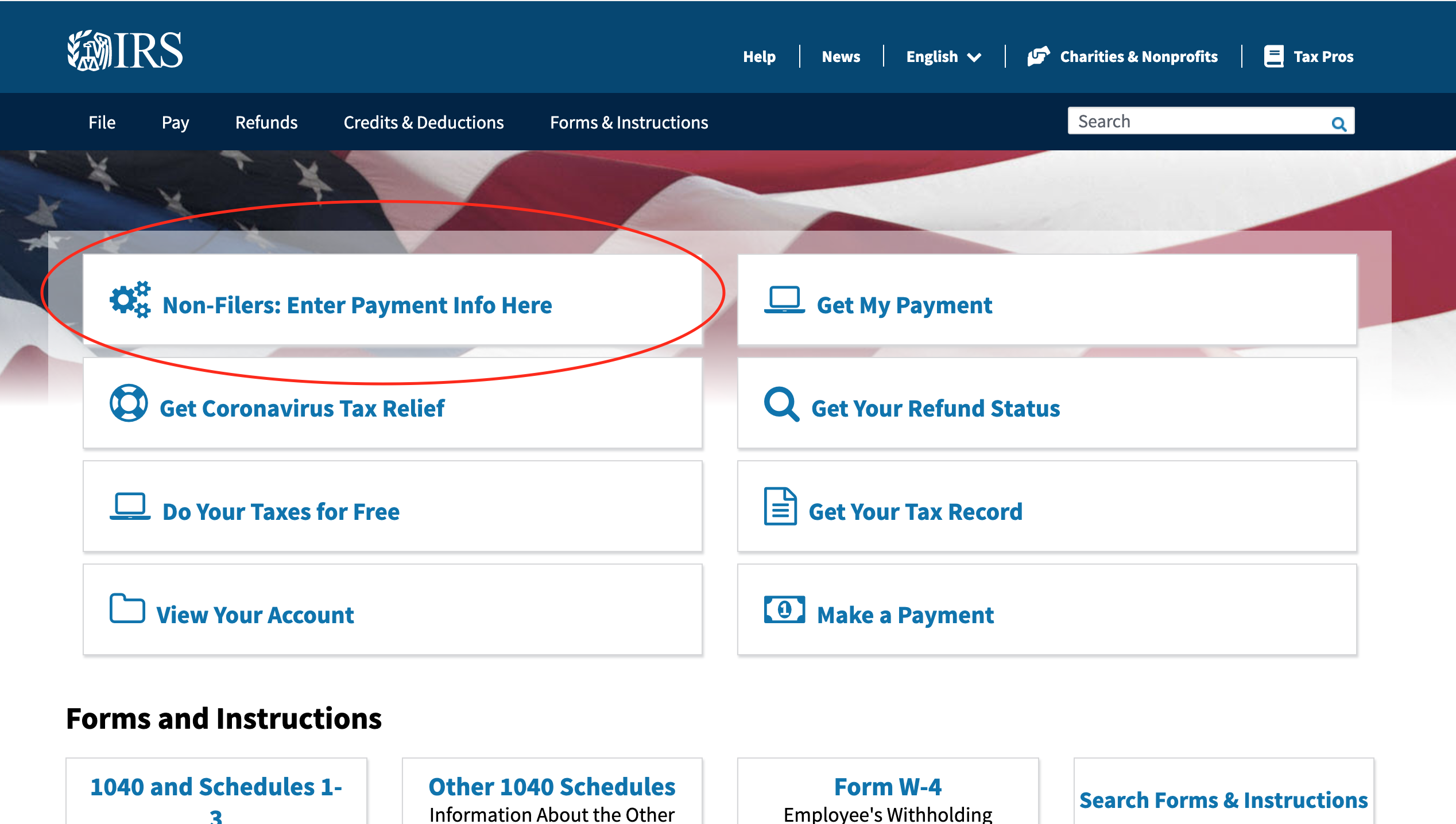

for Non-Filers: Enter Payment Info

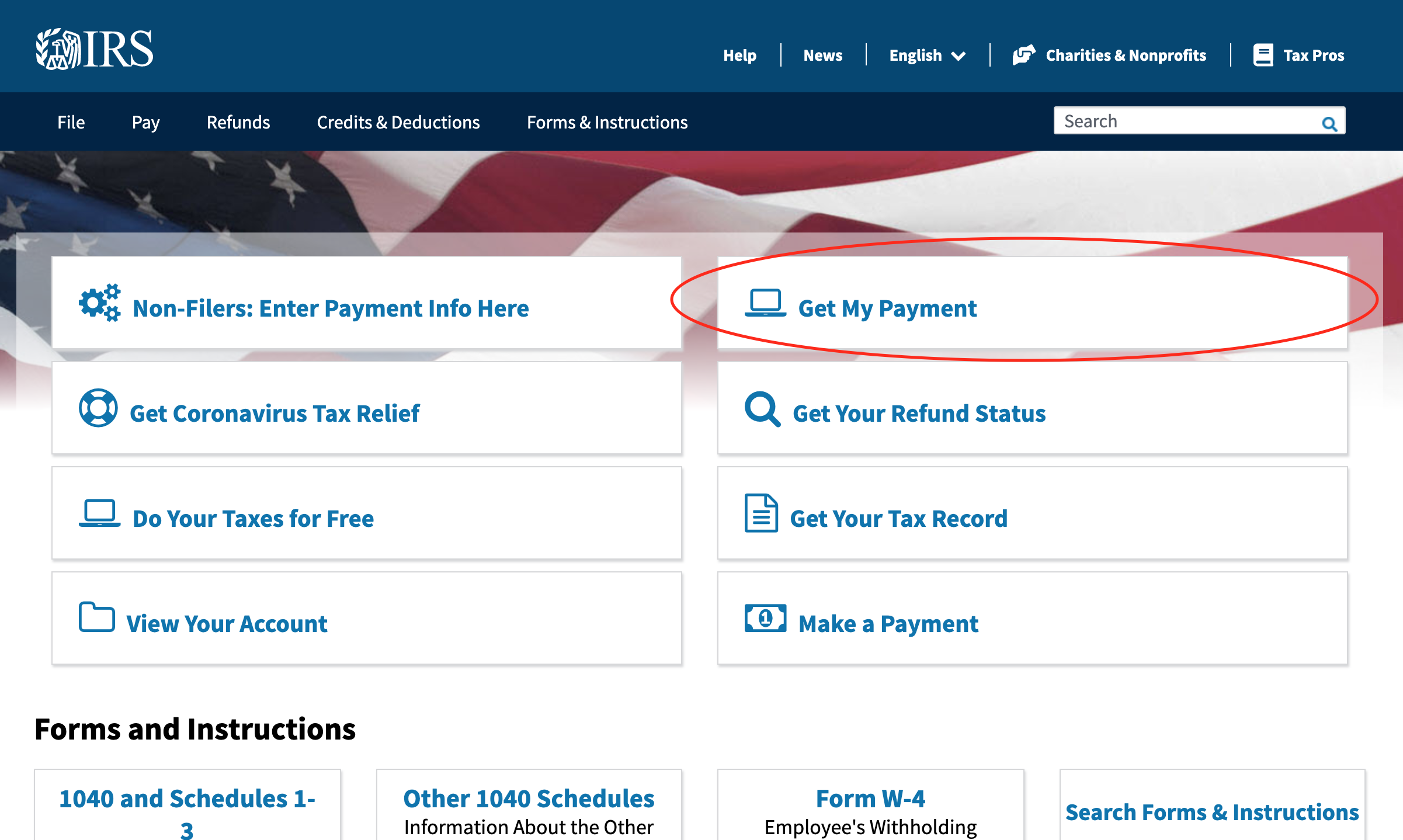

and Get My Payment

Non-Filers: Enter Payment Info Here

Information You will Need to Provide:

- Full name, current mailing address and an email address

- Date of birth and valid Social Security number

- *Recommended* Bank account number, type and routing number

- Optional Identity Protection Personal Identification Number (IP PIN) you received from the IRS earlier this year

- Optional Driver’s license or state-issued ID

- For each qualifying child: name, Social Security number or Adoption Taxpayer Identification Number and their relationship to you or your spouse

Follow these steps in order to provide your information:

- Create an account by providing your email address and phone number; and establishing a user ID and password.

- You will be directed to a screen where you will input your filing status (Single or Married filing jointly) and personal information. Note: Make sure you have a valid Social Security number for you (and your spouse if you were married at the end of 2019) unless you are filing “Married Filing Jointly” with a 2019 member of the military. Make sure you have a valid Social Security number or Adoption Taxpayer Identification Number for each dependent you want to claim for the Economic Impact Payment.

- Check the “box” if someone can claim you as a dependent or your spouse as a dependent.

- Complete your bank information (otherwise we will send you a check).

- You will be directed to another screen where you will enter personal information to verify yourself. Simply follow the instructions. You will need your driver’s license (or state-issued ID) information. If you don’t have one, leave it blank.

- You will receive an e-mail from Customer Service at Free File Fillable Forms that either acknowledges you have successfully submitted your information, or that tells you there is a problem and how to correct it. Free File Fillable forms will use the information to automatically complete a Form 1040 and transmit it to the IRS to compute and send you a payment.

Get My Payment

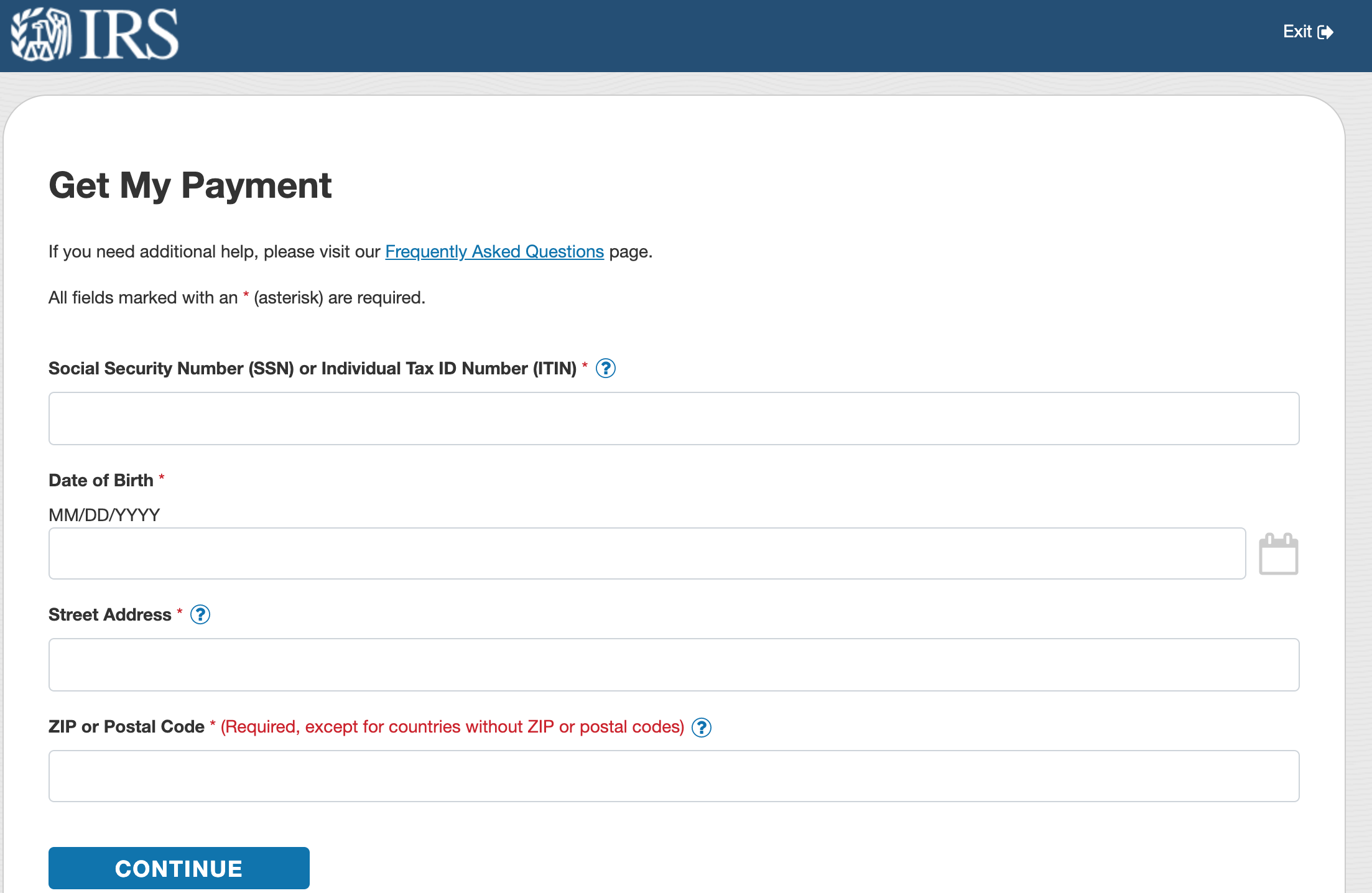

Enter all the information the website requests. Make sure this matches your 2019 or 2018 information. This is similar in format to the “Where is My Refund” webpage.

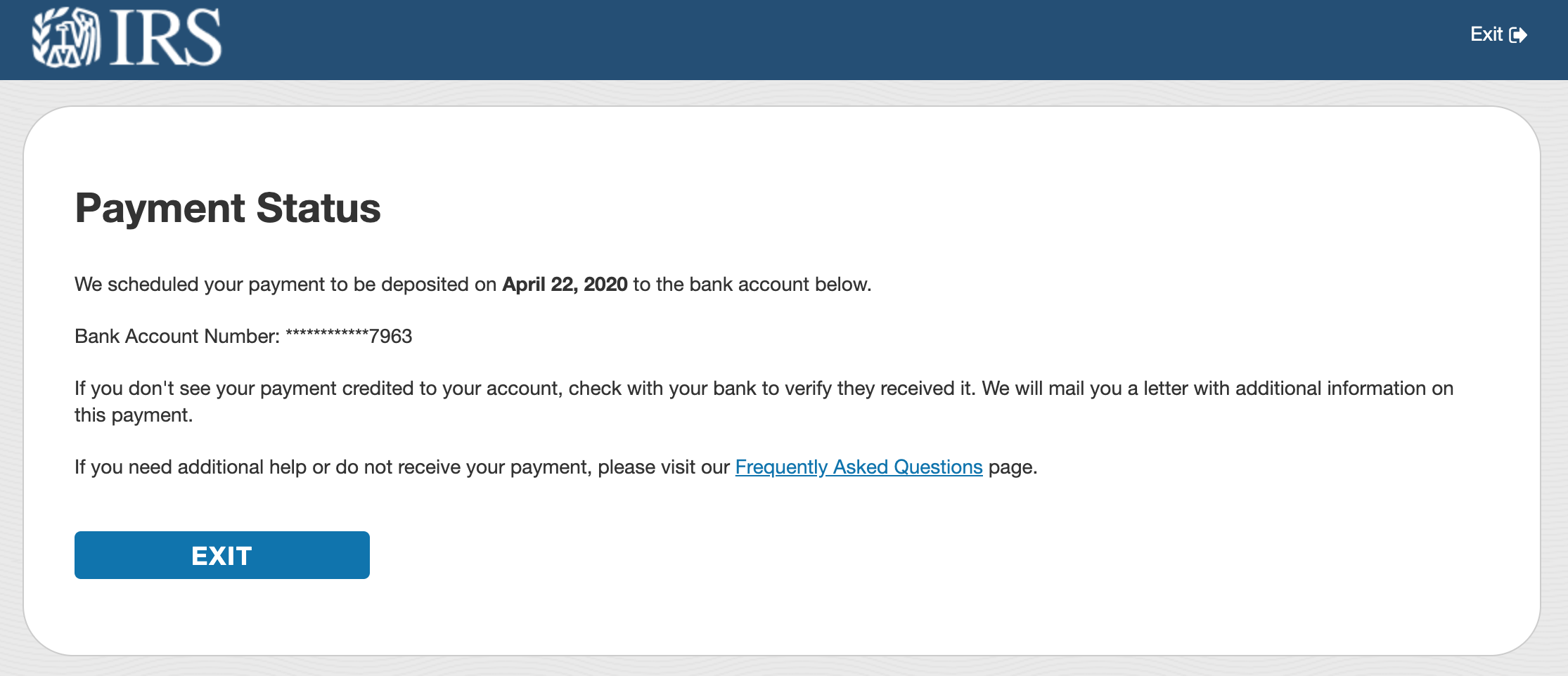

If your payment is being processed, the following message will be displayed. It will display when is your expected payment date (Direct Deposit) and to which bank account using the last four digits.

If payment has not been processed yet, “Get My Payment” also allows people a chance to (*Recommended*) provide their bank information. People who did not use direct deposit on their last tax return will be able to input information to receive the payment by direct deposit into their bank account, expediting receipt.

All others will have to wait for a paper check. If the bank account listed on this website is wrong or is an older, closed account, the payment will return to the IRS, but then you will have to wait for a paper check. There is no way around that.

|